The “Food Revolution” – investing in structural change in the food industry

Elad Ben-Am – 13.11.23

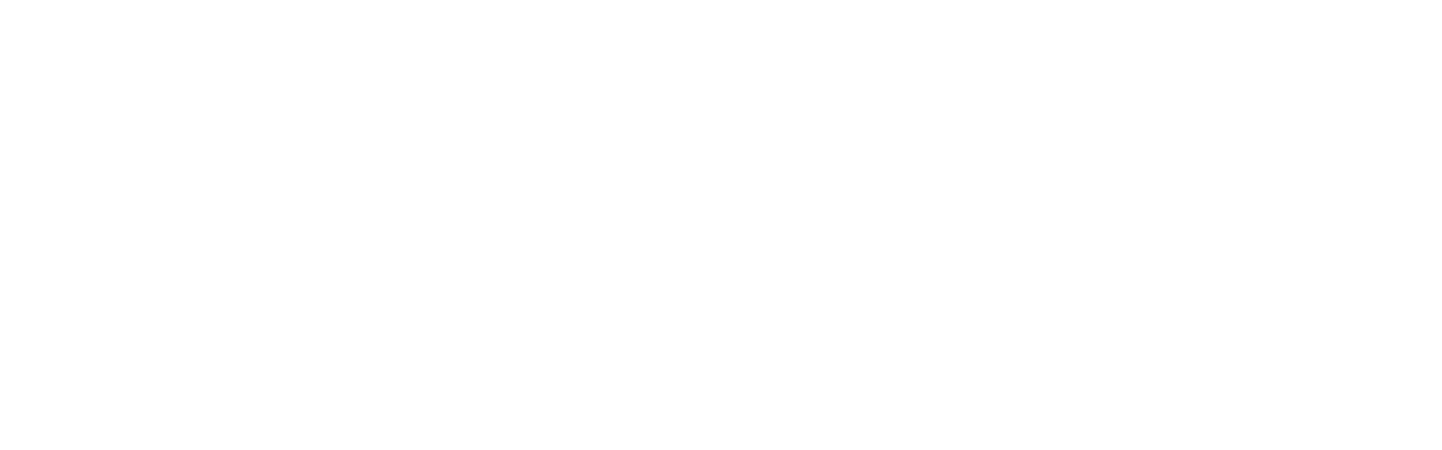

Our food industry is highly inefficient and marked by the structural overuse of natural resources. It accounts for 10% of the world GDP, but it generates over a quarter of greenhouse gas emissions, consumes half of the habitable land and uses 70% of the available fresh water (see Figure 1).

In view of an unresolved energy crisis, record droughts and structural agricultural land loss, this situation is already problematic for global food security. And it is likely to get worse in the coming years.

Closing the food gap is a major challenge

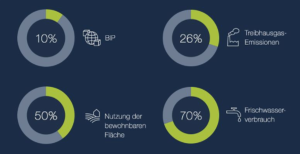

The world’s population is expected to grow to almost 10 billion people by 2050. At the same time, the average disposable income will continue to rise. According to estimates by the World Resources Institute, the total demand for food is therefore expected to increase by more than 50% (see Figure 2). In order to close this food gap with resources already overused today, the efficiency of the factors land, energy, water and labor must be significantly increased.

Food security and technology

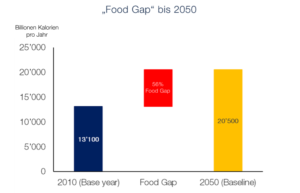

Technology plays a central role in the pursuit of a more efficient use and a more sustainable use of these resources, as can be seen in the overview below (Figure 3). This includes innovations along the entire agri-food value chain, from seed technology, precision agriculture or intelligent irrigation systems, to automation solutions in food production or logistics technologies.

These technologies are part of the structural change in the global agri-food system and will attract considerable financial resources in the coming years. The resulting investment opportunities are at the heart of the “Food Revolution” investment strategy.

According to estimates by the institute “The Food and Land Use Coalition”, this structural change will require annual global investments of USD 300 to 350 billion by 2030. The annual economic added value resulting from this transformation – in the form of lower external costs – is estimated to be 16 to 19 times this amount by 2030 (USD 5.7 trillion).

Why now?

The current environment on the capital markets, combined with the structural growth resulting from this transformation, offers very attractive opportunities for long-term investors. Rising interest rates and tightening financial conditions have led to a short-term capital outflow from the sector, resulting in a significant decline in valuation multiples (for listed companies) as well as investment volumes in the agrifood VC sector. Despite a decline of -44% in 2022, these investments have grown by an average of +25% per year over the last 10 years (see Figure 4).

This picture stands in stark contrast to the underlying fundamental development of the companies in the “Food Revolution” universe, which are benefiting more than average from the structural growth brought about by the transformation of the food industry.

If we take the development on the capital markets as an indicator, the “Food Revolution” appears to be a lesson in Amara’s Law, which states: “We tend to overestimate the impact of a technology in the short term and underestimate it in the long term.” Indeed, in the wake of the pandemic, euphoria erupted around the topic, resulting in overly high short-term expectations and subsequent disillusionment. However, the de-rating of the last two years has now pushed valuations to extremely low levels.

The “food revolution” is in full swing and has undoubtedly passed the point of no return. Technological innovation is key to closing the food gap that is opening up before our eyes. As investors, we have made it our mission to identify true technological innovators that are driving the transition to a more resilient and sustainable food system. This is a remarkable challenge that will attract significant financial flows and offer attractive investment opportunities for those who know where to look.

Elad Ben-Am is the Head “Food Revolution” at Picard Angst. He and his team manage the PA UCITS Food Revolution fund.