Gold – money and commodity of the hour

Oliver Holzer – 18.03.24

Let us start by giving you a few facts about gold as a raw material:

- All the gold that has been mined worldwide to date amounts to a cube with an edge length of around 22 metres. This cube could be placed under the Eiffel Tower. Or you could fill two 50-metre Olympic swimming pools with it. That’s all there is. Gold is and remains a rare commodity, a rare tangible asset.

- Around 3,100 tonnes of gold are currently mined every year. This corresponds to an annual growth in the amount of gold of around 1.48 %.

- Gold has served as money for over 5,000 years and is not tied to mountains of debt like paper money.

- Gold was the first official medium of exchange for international trade. Since then, gold has gloriously survived the rise and fall of several empires. Gold has seen several currencies come and go. That is why gold does not have to yield interest, because unlike paper money, gold retains its value.

- In relation to global government debt (around USD 95 trillion), the value of all the gold held by central banks worldwide is only around 2%. If all global debt is added together, all the gold mined to date equates to only around 3.5% of this sum.

- Good to know: central banks can buy much more gold than investors have on offer.

Gold vs. paper

What would happen if, for example, China were to peg the yuan to gold? The yuan would rise sharply in value against the other currencies. Conclusion: Gold is significantly more valuable than unbacked paper money.

The former US Federal Reserve Chairman, Ben Bernanke, expressed the following possibility during his time in office: “The US government has a technology called the printing press. It can produce as many dollars as you want”. The US dollars created electronically by the Federal Reserve and commercial banks already dominate this unlimited multiplier.

“The level of distrust/confidence in the monetary policy of the central banks (as well as the level of confidence in economic and geopolitical developments) can be seen from the physical demand for gold, which supports the gold price trend.”

Rising gold price

For the first time in around 20 years, the price of gold is rising even without investor demand. Various central banks have offset investor sales with their purchases. The reasons: Following Russia’s invasion of Ukraine, Russia was cut off from trading in US dollars. As a direct consequence, the BRICS countries in particular have started to diversify part of their US dollar currency reserves into gold and other real assets. In 2022 and 2023, these central banks (China clear number 1) bought up around 33% of annual production. This trend is likely to continue, especially as the arguments remain unchanged. In previous years, this figure was somewhat lower on average, at around 10% of annual gold production.

For the immediate future, we expect a stagflation-like scenario. In the past, gold has performed much better than equities in a stagflationary environment and has risen significantly despite rising interest rates. Under these circumstances, financial investors will also build up or expand their gold holdings again. This would give the gold price an additional and sustained boost.

Gold mining shares

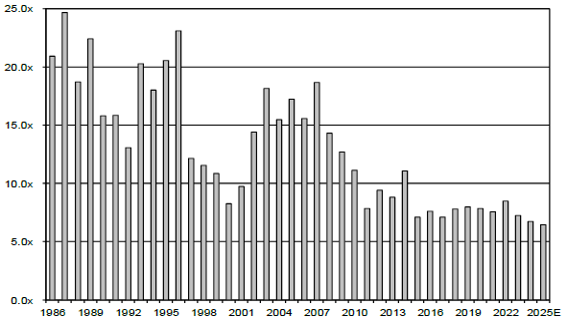

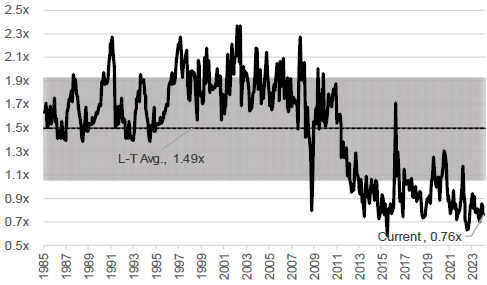

The gold price is trading close to its all-time high. That is not the case for gold mines. One of the main reasons is probably the fact that the central banks are only buying physical gold, but not shares in gold mining companies. We assume that investors will soon return to the market as buyers of gold and at the same time also consider the extremely favourably valued gold mines as an investment or add them to their portfolio.

Almost all valuation ratios for gold stocks are close to all-time lows (35 years of data)! The North American gold producers are currently trading at a record discount of around 20 % to the gold price. The shares of gold miners are also more favourably valued than ever before compared to the physical gold price, i.e. in relative terms.

Most gold production companies have greatly improved their balance sheets in the last 10 years (massive debt reduction, streamlining of the cost structure, no expensive takeovers, etc.). This has resulted in solid free cash flows. In terms of financial results, gold mining companies are very transparent compared to the past and pursue a dividend and share buyback policy that is shareholder-friendly. Many gold mines now rely on solar power to generate energy, with which the required electricity can now be produced significantly more cheaply than with the conventional setup (diesel, etc.).

Konwave AG is a Swiss investment manager focussing on the mining industry with around USD 1.1 billion in assets under management. Over the last 25 years, we have significantly outperformed the comparable indices and our peers and recently received the Lipper Award for the best gold mining fund in Switzerland over the last 10 years.

Summary: Outlook for gold and gold mines

|

Physical gold marketNew demand situation due to geopolitical tensions (NATO vs. China, RoW) leads to excess demand. Gold rises for the first time in around 20 years even without investor demand (analogue since Q4, 2022) |

|

Macro outlook (relevant for investment demand)Rotation on the financial markets from long duration assets (decreasing expectation of FED interest rate cuts due to stubborn inflation) to winners in the stagflation-like scenario (similar to Q1, 2022). Gold and gold mines even more pronounced best asset class in this scenario. |

|

Micro outlook for gold minesFalling cost pressure (costs in Q1, 23 below consensus expectations). Extreme undervaluation relative to gold, its own past and other asset classes. Significant expansion of profit margins, FCF and profits with rising gold price. |

|

Behavioural economics (behavioural finance)Extreme disinterest in gold and gold miners, high ETF outflows since April 2022 (declining and starting inflows) and modest COMEX positioning. Rising investor interest should lead to significant outperformance. |

|

Technical analysisGold near all-time high. There is no “quadruple top”, i.e. a breakout to a new all-time high in the coming weeks/months is very likely. |