New technologies are conquering the healthcare industry and improving care while reducing its cost. This development is urgently needed since demographic changes such as the ageing of the world’s population require greater efficiency and cost-effectiveness in the healthcare sector.

What are the major challenges and opportunities in the field of digital health? How do we benefit from innovations, not only in the event of a medical emergency, but also as investors?

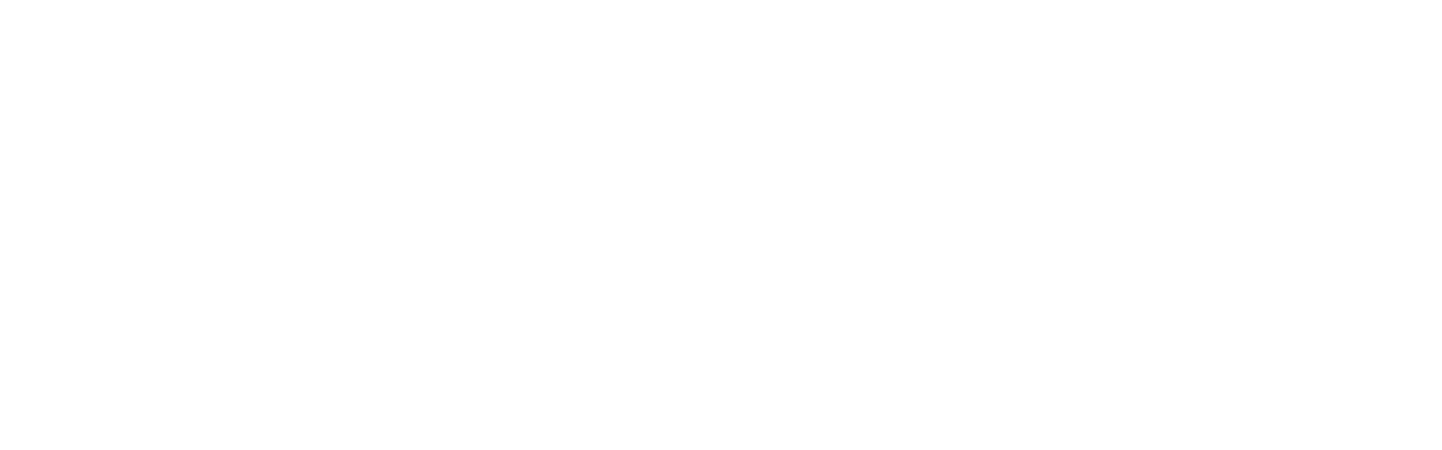

Digitalisation in the healthcare sector has already made great progress and significantly improved the quality of treatment. Analogue systems have been replaced by digital X-ray images, cloud-connected continual blood glucose monitoring sensors and electronic patient records. Consequently, an enormous amount of health data has been collected, which now serves as a training basis for the large generative AI models. This, in turn, is significantly accelerating innovation in the healthcare sector.

Investment in artificial intelligence (AI) and its successful implementation will determine who the future winners in the healthcare industry will be in the coming years. From an investor’s perspective, it is therefore worth investing in those healthcare companies that have already integrated GenAI into their business models. The companies that are successful in doing so will emerge as share price winners over time.

Why is GenAI so relevant for the healthcare sector?

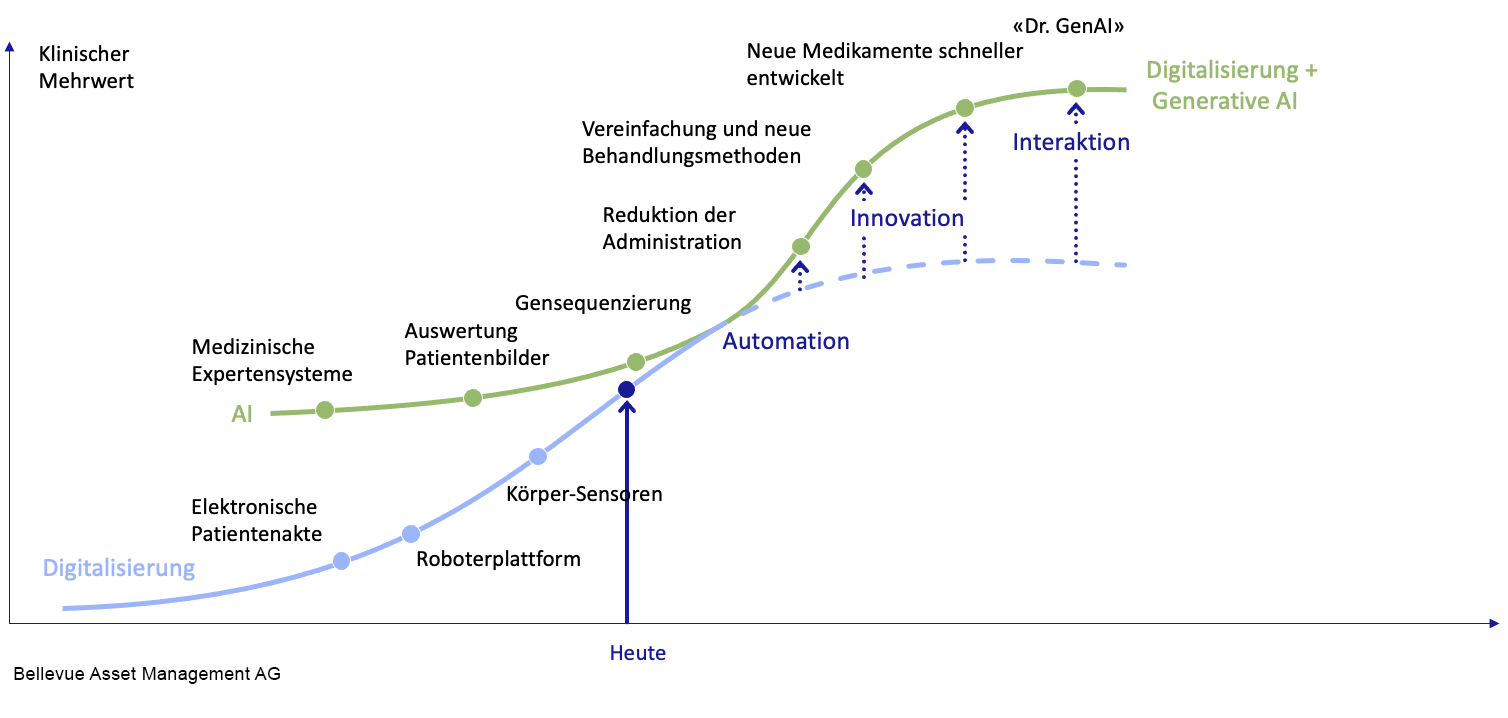

The healthcare sector is marked by enormously complex problems, for example in drug development. Lengthy development times and high failure rates cause the cost of a new drug to skyrocket into the billions.

GenAI technology can optimise the use of existing data from studies, research, development and patient data. This will not only allow drugs to be developed faster and in a more targeted manner in the future, but will also reduce the risks involved in development. New drug candidates can be identified more quickly, selected more successfully, optimised digitally and tested faster in laboratory experiments. This, again, generates large amounts of new data of the highest quality and new findings. The result is a ‘flywheel effect’, also for the share prices of pharmaceutical and biotech companies that successfully invest in GenAI.

AI against system inefficiencies

Another promising field of application for GenAI is the healthcare service sector, where there are massive system inefficiencies. One major beneficiary is the field of medical technology. The optimisation of methods of treatment significantly improves the quality of the treatment itself. For example, GenAI is not only used in diagnostic imaging, but also in AI-guided ultrasound examinations, sensor-based continuous blood glucose monitoring, surgical robotics and the early detection of heart failure and cancer. As a result, these ‘blockbuster markets’ are experiencing significant double-digit growth with the potential to double.

Assisted operations

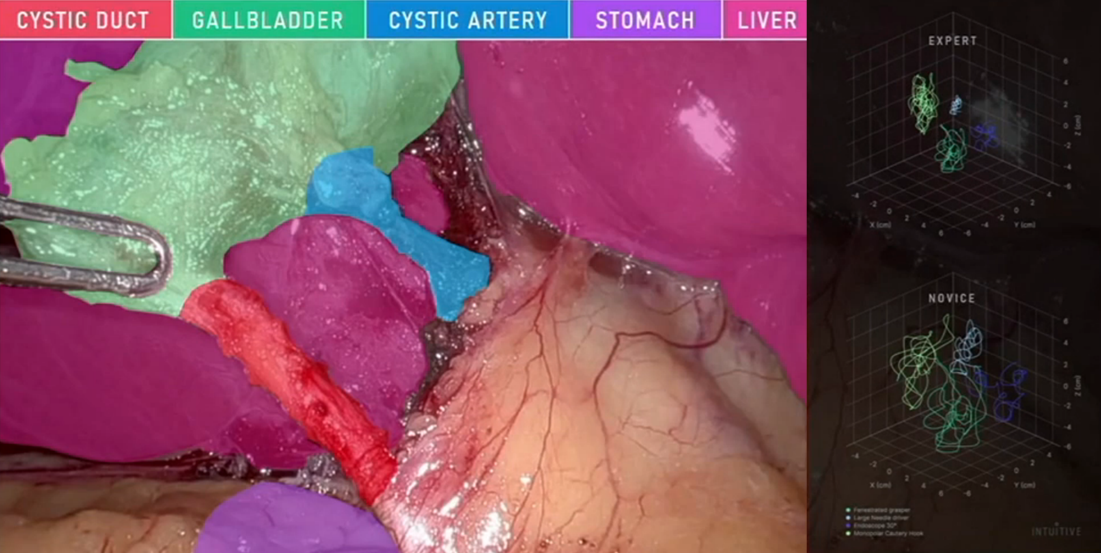

Thanks to the latest generation of da Vinci 5 (dV5) surgical robots from Intuitive Surgical, patients and surgeons are already benefiting from GenAI technologies. Just as a Tesla can recognise pedestrians, cars and lorries in the vicinity of the route, dV5 automatically recognises the various vascular structures (coloured in the image on the left). dV5 can make suggestions for the next surgical step in accordance with clinical guidelines, monitor the operation and collect and ultimately evaluate all the data. As can be seen in the image on the right, statements can be made about the surgeon’s level of training and individual training units can be defined. Overall, this prevents complications during surgery, which increases the quality of treatment and reduces overall treatment costs.

While the surgeon controls the dV5 surgical robot entirely herself – unlike in the Tesla example, the robot does not carry out surgical steps autonomously – there are already surgical systems such as Hydros from Procept BioRobotics that can carry out surgical planning and the removal of excess prostate tissue independently. The surgeon exclusively monitors the entire process: she verifies the surgical plan generated by the GenAI, improves it if necessary, monitors the automatically performed tissue removal and intervenes if something unforeseen should occur.

How can you profit as an investor?

The Bellevue Digital Health (and Medtech & Services and AI Health) Fund invests in this megatrend. From a fundamental perspective, digital health companies are on a stable, above-average growth trajectory that is likely to continue unchanged in 2024. The approval and market launch of relevant new products will ensure continued high sales growth. Examples include the aforementioned Stelo and G7 blood glucose sensors from Dexcom, the new robot-based da Vinci 5 surgical system from Intuitive Surgical and Hydros from Procept BioRobotics.

We expect a tailwind for our investment solution for the remainder of 2024 and all of 2025. Factors such as the first US interest rate cuts due to a slowdown in the US economy (growth stocks usually benefit more than average), attractive valuation levels (sales multiples close to historical lows), expected acceleration of M&A and IPO activity, repositioning of investors from the high-flyers of recent months into high-quality stocks speak in favour of an investment in the Bellevue Digital Health (Lux) Fund.

|

Stefan Blum is Senior Portfolio Manager of Bellevue Medtech & Services (Lux), Bellevue Digital Health (Lux) and Bellevue AI Health (Lux) Funds. |